It is always best to consult with an experienced St. Louis car accident lawyer to make sure that you aren’t left paying for something that isn’t your responsibility.

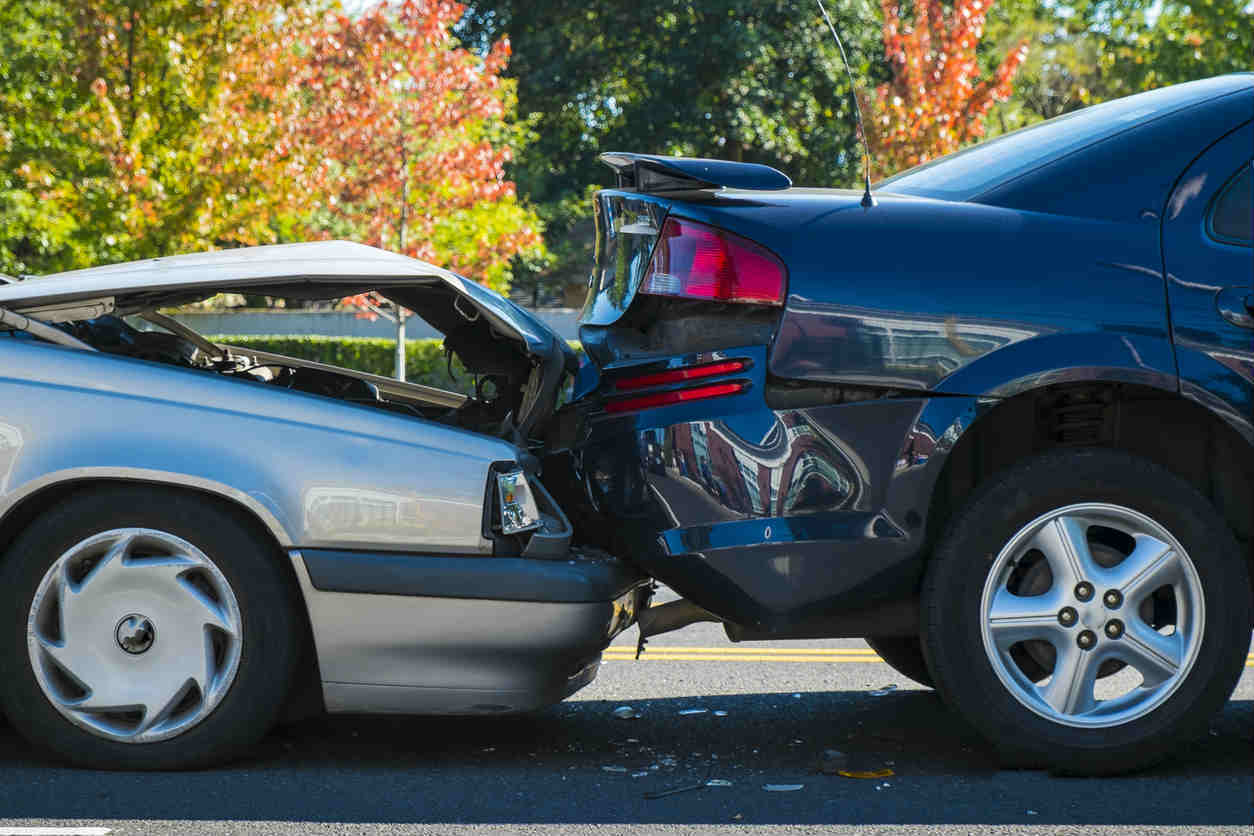

Car accident insurance laws are all mandated at the state level. Each state is responsible to set the laws and liability for drivers within the state. As of 2012, statistics show that close to two and a half million people were injured in car accidents and that over thirty-three thousand were killed. That means that the total cost of auto collisions nationwide is somewhere near $870 billion. Due to the high cost incurred at the state level for car accidents, there are mandatory insurance minimums required.

The minimum requirements for Missouri are that you need to have coverage for any injuries that are related to your negligence. To drive in Missouri, you need mandatory automobile liability insurance. The minimum coverage must be $25 thousand per person, $10 thousand for any property damage and $50 thousand per car accident.

Although there is a minimum that you need to have according to the state, any money that goes over your coverage becomes your responsibility. Since Missouri is an “at-fault” state, it means that whichever driver is found at fault in an automobile accident is responsible for paying for any damages or injuries. That is why it is so important to ensure that you are fully insured and that you aren’t just purchasing the minimum that could open you up to some potentially disastrous economic consequences.

What are liability limits

When you take out an insurance policy, you will want to pay close attention to something called “liability limits”. The liability limits are the amount of money that the insurance carrier will cover if you are at-fault for an auto accident. If the bills go beyond that specific dollar amount, it will be your responsibility. Since there are different types of damages that someone can sue for, it is imperative that you be covered for all situations that can happen by taking out additional coverage when necessary.

The most common types of coverage categories are

- Bodily injury liability

- Personal injury protection

- Property damage liability

- Collision coverage

- Comprehensive coverage

Uninsured/underinsured motorist (UM/UIM) coverage

In Missouri when you take out the mandatory minimum insurance required, you are generally covered for bodily injury liability, and, typically, personal injury protection. This means that you are responsible for anything that is outside of what that covers. Things like collision insurance will help if your property is damaged and you are at fault, while UM/UIM coverage will insure you if you are hit by someone who isn’t carrying the insurance required by law.

Speak With a St. Louis Car Accident Lawyer

The key to making sure that you aren’t left vulnerable is to speak with your carrier and understand where additional coverage might be needed. If you get into a car accident, it is always best to consult with an experienced St. Louis car accident lawyer to make sure that you aren’t left paying for something that isn’t your responsibility.

If you have been involved in an accident, call (314) 361-4242 for a free personal injury case evaluation.